What are Trading Platforms?

Trading platforms are software that you install on your PC, run in a web browser or a mobile application installed on your phone for trading on financial markets. These options are provided for traders to trade any assets of their choosing provided they are offered by their broker. However, in choosing the trading platform you want to use, there are many things to look out for. It’s not just about what features or functions the trading platform has to offer. There are many trading platforms available. There is even a specific platform for trading different products. For the sake of this article let’s compare these two trading platforms; cTrader vs. NinjaTrader.

Introduction to cTrader?

cTrader is a platform devoted to Electronic Communication Network (ECN) trading. It is a ground-breaking trading condition, which previously didn’t exist for retail traders. ECN trading and Direct Market Access (DMA) offer many highlights, for example, VWAP trading and deep visibility of the market. The cTrader execution speeds are unparalleled. The servers of the representative are facilitated by esteemed server farms in London. Web trading interfaces and versatile mobile trading applications are clearly additionally accessible.

Talking about the user interface, this platform is attractive, elegant and easy to use. The screens are easy to navigate and intuitively designed, giving cTrader an edge over more complex platforms. cTrader – STP Forex Trading Platform.

Characteristics of cTrader

In order to compare cTrader vs. NinjaTrader, let’s firstly look at cTrader. A platform which is well documented on this website. cTrader offers three chart modes: a single chart, multiple charts, and a free chart, which can be used to get different views of market trends based on user preferences.

cTrader provides a comprehensive assessment of market depth with three distinct views: standard depth, price depth, and depth of the VWAP. With these features, traders can closely monitor the liquidity of the market at different prices, allowing them to make more accurate entries.

Also, cTrader offers its algorithmic trading tool called cTrader Automate, which allows traders to program robots for transaction execution, client indicator creation, strategy execution and backtest.

The platform offers a wide range of indicators such as moving averages, MACD, Bollinger, etc. for the analysis of market data. cTrader offers many time periods, including the usual 1/5/15 minutes and more.

For more information about cTrader, you can check a complete review of the platform here.

Introduction to NinjaTrader

Now to compare NinjaTrader vs. cTrader. NinjaTrader is a trading platform mostly for the retail trader. It is unlikely that any hedge fund would be using this platform. The platform is owned by NinjaTrader LLC, a US company. NinjaTrader LLC is a member of the National Futures Association (NFA # 0339976), well known for providing top-notch trading options. NinjaTrader uses Advanced Trade Management (ATM) technology which made them excel in the broad field of trade management. To this end, the indicator under study helps to ensure open client agreements.

The NinjaTrader platform allows trading of CFDs, stocks, foreign exchange contracts and futures contracts. The NinjaTrader platform is used by many popular brokers which are based in the United States. Those are NinjaTrader Brokerage Services, Forex.com (Capital GAIN), FXCM etc. Unlike cTrader which is only a platform provider, NinjaTrader is actually a broker as well.

Features of NinjaTrader

On NinjaTrader you can trade CFDs, stocks, foreign exchange, options and futures. The NinjaTrader platform is used by many popular brokers. This is the most obvious difference between the two platforms since cTrader only offer CFD trading. At a glance, NinjaTrader shares many features with cTrader, such as a rich charting package which offers many customization options and trading directly from the chart. Also, there is a variety of order types, algorithmic trading with backtesting and optimization capabilities and a trade analysis tool.

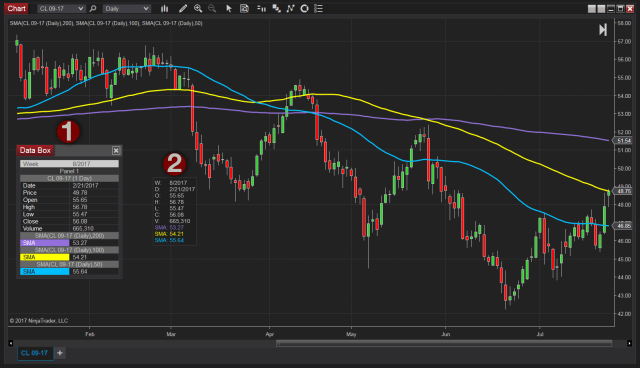

NinjaTrader User-Interface

In general, the user interface looks a little bit complicated and nowhere near as crisp and sharp as cTrader. It does, however, look ten times better than MetaTrader 4, but that’s not hard. If you have ever seen a trading platform used as a movie prop, NinjaTrader looks a bit like that. There a number of different screens inside the platform, with each screen has its own context. For example new order windows, chart panels and tickets. The interface is classic with a decent amount of information displayed throughout.

The NinjaTrader platform is one of the industry’s best-known standards for transaction management and order entry. So let’s take a look at the platforms order types.

Order Types

As expected, NinjaTrader provides traders with several order entry options, including the Basic Entry, SuperDOM and Chart Trader interfaces. More advanced order types, including Market Touch (MIT) and One Cancels Other (OCO), can also be valuable tools for traders.

Besides these more unique order types, which cTrader mostly doesn’t offer. They are all derived from 3 basic order types. They are Market Order, Limit Orders and Stop Orders. Based on these order types the platform’s software developers are able to develop more complex order types, such as the ones mentioned already and others such as Stop-Limit Orders

Client Support

NinjaTrader offers 24/7 Support, webinars, good user guides which involve installation guide on how to install the NinjaTrader platform. To do this, you must have the following minimum computer configuration: Windows software: Windows 7, Windows 8 or Windows 10, Minimum screen resolution of 1024 x 768; Processor P4 minimum or higher; 2 GB of RAM.

Range of indicators

With over 100,000 customers trading with these indicators, it’s certain they have been thoroughly tested. These indicators will help you as a trader to implement your trading strategy.. Part of the indicators is Moving Average Ribbon, Disparity Index, Net Change Display, Money Flow and Oscillator, Price Line. These indicators are pretty much mainstays in the world of online trading but they are essential nonetheless.

cTrader vs. NinjaTrader

How do cTrader and NinjaTrader square up against one another? Let’s compare considering some of the main criteria for evaluating a trading platform.

The User Interface. cTrader is known for its fluid, organized and intuitive interface. Although the popularity of NinjaTrader is certainly unmatched, in terms of user interface and ease of use, the cTrader platform is potentially the best. Obviously, it will depend on the individual, for example, an older person might prefer NinjaTrader whereas a younger person would not. Beginners will probably prefer the ease of use provided by cTrader.

The Cost. Unlike cTrader trading platforms, NinjaTrader is not totally free. There is a free version with basic features, but advanced versions of the NinjaTrader platform comes at a price.

Automated Trading. NinjaTrader offers expert advisors that are easy to use, customizable, and work well for new operators and specialists; while cTrader is equivalent to a programmable command in C#. However, NinjaTrader advanced account is still widely regarded as having the best support features in its class for its automated trading tools, but cTrader has caught up fast in recent years.

Trading Community. Both platforms have a loyal following. But the NinjaTrader community is more mature and experienced. Online communities are important. They make it easier for them to find support online.

Market Depth Functionality. Understanding the depth of the market is important as it shows access to liquidity and trading at specific prices. cTrader offers three options for in-depth market assessment, these are standard depth, price depth and VWAP depth. However, NinjaTrader offers only one characteristic of the depth of the market. cTrader is above NinjaTrader when it comes to providing traders with a quick and easy way to take action on depth of market information.

The Conclusion to cTrader vs. NinjaTrader

Unlike MetaTrader 4 or MetaTrader 5 platforms, NinjaTrader is actually quite a well made and trader focused platform. This immediately aligns it with cTrader. The efficiency and effectiveness of both trading platforms cannot be overstated. NinjaTrader is popular for its simplicity, flexibility, built-in tools and expert advisors. But its subscription package might be a big turn-off. However, the strength of cTrader lies in its excellent user interface, its sophisticated features such as market depth, as well as its various indicators and calendars. It is easy to adopt cTrader for beginners since it has a user-friendly interface. Therefore, to conclude the battler of cTrader vs. NinjaTrader, we say cTrader offers the best option on the market for forex trading.

Comments are closed.