Introduction to Trader’s Way Review

Trader’s Way is a veteran in the online Forex trading space. The company has been active for more than 10 years, thus making them a well-experienced broker. Like many brokers, the company launched with the MetaTrader 4 platform and later introduced cTrader and MetaTrader 5. Moreover, Trader’s Way has been offering the cTrader platform since the start of 2012. Due to the initial exclusivity period given to FxPro which lasted from the initial launch of cTrader until the end of 2011, we have it on good authority that Trader’s Way is the broker to offer the cTrader platform.

If you were to go through the textbook checklist for a newbie forex trader, Trader’s Way may not get a high score. But that’s because the newbie’s checklist is in fact, for newbies. As the entire forex trading industry is shifting and shifting fast, thanks to new regulatory changes, the rulebook is being rewritten. Brokers like Trader’s Way are the future. We would say Trader’s Way is not a company for newbies, but for traders who are looking

Here are some of the things we like about this forex broker;

- High leverage availability. Trader’s Way offers leverage up to 1:1000. In the case of cTrader it is just 1:500.

- The minimum deposit needed to get started with is just $10. Combine that with 1:1000 leverage, you can trade a few nano lots.

- No pushy sales tactics. No one ever called us or emailed us to get us to complete account verification and make a deposit.

- Offshore. Trader’s Way is incorporated in a jurisdiction that doesn’t have forex regulation. This means they can operate how they see fit, which is thankfully in a sustainable way. They will not succumb to regulatory clampdown on leverage.

No review would be complete without a critical element. Here are some of the things we do not like about Trader’s Way;

- Expensive payment methods. Unfortunately, due to the fact that Trader’s Way is based offshore, they do not have decent payment methods available to them. This makes deposits and withdrawals more expensive and more complicated.

- Do not treat cTrader accounts equally. This is a common occurrence which we will hope stops in the future. Unfortunately, cTrader accounts come with lower leverage, and Swap Free is not offered.

About Trader’s Way

Trader’s Way is what you may call a low-key or on the down-low sort of broker. Their positioning in the market is somewhat understated. This would seem to be strategic. The company has been around since at least 2011. This indicates the company has an operational track record. Companies interested in a quick buck don’t last anywhere near as long as Trader’s Way has. They either get chased by law enforcement or decide they have conned as many people as they could have and shut up shop. Trader’s Way is unregulated and this is seen as a red flag to many. But the industry is going through some drastic changes at the moment. As much as regulation protects investors, it also suffocates brokers in terms of what they can offer to traders.

| Year Established | 2011 |

| Year Started Offering cTrader | 2011 |

| Country | Dominica |

| Regulation | None |

| Number of Employees | 10+ |

Trader’s Way Trading Conditions

Over the past few years, brokers have branched out and started offering alternative products like indexes, stocks, commodities and more. Trader’s Way has kept things simple. The offering is relatively streamlined and focuses almost exclusively on forex products.

| Maximum Leverage | 1:1000 (1:500 on cTrader) |

| Asset Classes | Forex, Metals, Energies |

| Total Number of Trading Pairs | 45 (44 on cTrader) |

| Trading Commissions | $6 per Lot ($30 per mil.) |

| Account Currencies | USD, EUR, CAD, GBP (only USD on cTrader) |

| Minimum Deposit | $10 ($50 on cTrader) |

| Spreads | From 0.0 (on ECN accounts) |

| Stop Out Level | 40% |

Accessibility to Trader’s Way Services

Trader’s Way is one of the most accessible cTrader brokers we have seen so far. While the companies website states that the information is not directed toward soliciting citizens or residents of the United States and the United Kingdom, it doesn’t necessarily say they are not accepted nor welcome. We have it on good authority that Trader’s Way is open to working with USA residents. We have seen some chit-chat in a number of forex trading forums that Trader’s Way are accepting US clients, but not for the use of cTrader platform, only MetaTrader 4 and MetaTrader 5. Currently, it’s very difficult, perhaps impossible to find a forex broker that will onboard US clients. As for Canadians too, who recently had the door closed on them by a number of brokers, they should be able to still trade with cTrader with Trader’s Way.

As for deposit options, the company is working mostly with alternative payment providers. This is mostly due to the fact that forex is considered a high-risk industry and amplified by the fact that Trader’s Way is considered an offshore brokerage.

| Countries Excluded | Sanctioned countries only |

| Deposit Options | Vload, Instacoins, Cryptocurrencies, Abra, Skrill, Neteller, FasaPay, Perfect Money |

| Withdrawal Fees | Varies significantly depending on the method. |

| Social Trading | Yes |

Promotions

Trader’s Way offers a 100% deposit bonus. This bonus is available on MetaTrader

4 only, unfortunately. But it’s still a great tool for traders looking to max out their position sizes with minimal margin requirements. For every Lot you trade, $0.50 of your bonus credit will be converted into balance. This bonus gets converted into balance at the end of each day. So it not only acts as extra leverage, but it also acts as a rebate too. More information about the 100% deposit bonus can be found on the Trader’s Way website.

Our Experience with Opening a Trader’s Way Account

Verifying Our Account

After having our demo account for over 2 months, we proceeded with verifying our account to get a live account. First of all, we uploaded incorrect documents. We did this to review their response. We received a no-thrills template informing us of the issue and how to do it correctly. After providing the correct documents, our account was verified within hours.

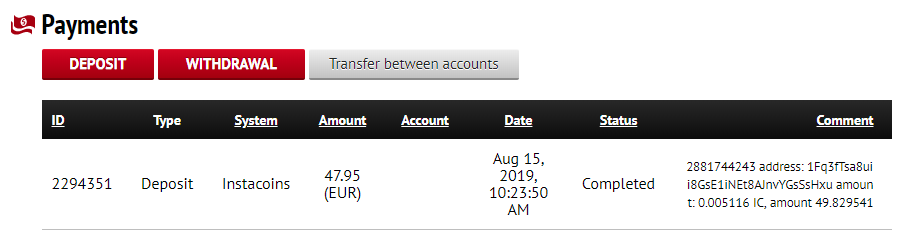

Depositing with Instacoins

A few weeks after we verified our Trader’s Way account, we decided to proceed with making a deposit. Since we wanted to deposit via a Visa card, we compared the methods available and decided that Instacoins was a good option. Using the Instacoins method required us to do KYC again, with Instacoins. We are quite experienced at working with forex brokers and understand about KYC and why it is important, so we accepted this situation. Some traders might not be as keen on this.

Through Instacoins, we purchased 50 EURO worth of Bitcoin. This Bitcoin was deposited to a Trader’s Way BTC address and converted back into EURO and deposited into our account. It sounds confusing, but if you have experience with crypto exchanges and forex brokers it will come naturally to you. Unfortunately, we bought €50 but what was deposited after conversion was €49.83. Furthermore, there was a fee of 3.9% charged. In the end, it was €47.95 that was received into our account.

The Client Zone

In the case of Trader’s Way, they call their client zone the “Private Office”. In our opinion, it’s a no thrills and easy to use interface that does what you need it to do. We’ve seen other brokers with far more complex client zones where it can take a few minutes to find what you are looking for. The interface shows your selected account and all of the options, such as deposit and withdraw are in the context of that account.

Withdrawing from Trader’s Way

As for withdrawing, the most simple way for us was to withdraw via Bitcoin. This meant the least amount of intermediaries having to be involved. All we had to do was give a BTC address and we received our funds back. This was a good solution for us, but due to the complex nature of Bitcoin and volatility, other traders may not want to withdraw into BTC. Since this broker has a number of alternative payment methods on offer, it would not be an easy task to explain them all. If you are interested, we suggest taking a closer look. What we can say is that it’s not realistic to expect a direct bank withdrawal, we saw SWIFT withdrawal fees as high as $150.

Conclusion

In conclusion, we would say that Trader’s Way is not the best option for traders who are new to forex. In our opinion, there are other brokers with a more simplified approach and are more suitable for newcomers. Trader’s Way is, however, a great option for traders whose prefered trading conditions are threatened by regulation, in particular, leverage. Not sure if Trader’s Way is right for you? Take a look at the other brokers we have reviewed.

Comments are closed.